Some ‘too big to fail’ funds have suspended payments to investors who want to withdraw their cash.

The root of the problem is property valuations.

Rules governing the funds laid down by City watchdog the Financial Conduct Authority warn that a fund must suspend trading when independent surveyors are uncertain of the market value of at least 20% of the fund’s properties.

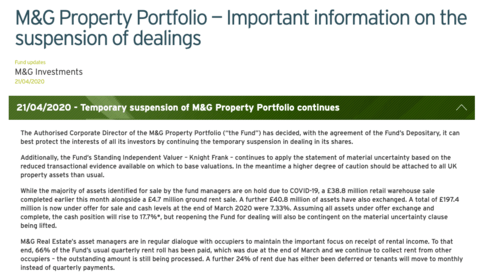

The £2.5 billion M&G Property Portfolio shuttered on December 4 last year.

Since then investors have been denied access to their cash but the fund has continued normal day-to-day trading.

Tony Brown, Global Head of M&G Real Estate, said: “We take our responsibilities as a major commercial property owner seriously. We are supporting tenants to protect businesses in distress, whilst also protecting the interests of savers and pensioners whose money is invested in our buildings.

“We are doing all we can to preserve value during this period of market stress and are working with occupiers to balance business continuity with delivering returns at this difficult time.”

Funds in the same boat include the £500 million Kames Capital and £460 million Aviva Investors Property Funds which were suspended alongside the Janus Henderson property fund in March.

Ryan Hughes, head of active portfolios at investment platform AJ Bell, said: “Investors will understandably find these closures distressing at such an uncertain time in markets. However, there’s nothing they can do now but wait it out and hope that the suspensions don’t drag on for too long.

“The length of the M&G closure highlights that it’s not a quick task to offload large property assets in order to generate cash, and current market conditions will only make that harder.”

Meanwhile, although buy to let lenders are offering restricted funds to borrowers, property investors need to be wary of the price that they are paying for homes during lockdown.

Although many may seem a bargain, the impact of coronavirus on the market is still at best a guess.