Landlords have a lack of confidence in the future of buy to let after a flurry of blows from the government and regulators, according to a new survey.

The study revealed 59% of landlords have a negative outlook for their property businesses even though only 3% are posting rental losses.

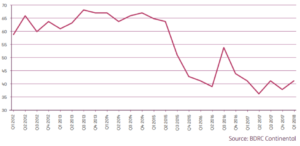

Their view has reversed since the third quarter of 2015, when nearly two out of three were confident about the future of buy to let.

The U-turn has followed tax reform by raising stamp duty for landlords and scrapping higher rate mortgage interest relief.

At the same time, regulators have made mortgage underwriting stricter for portfolio landlords with four or more homes for rent.

This has led to the growth of buy to let slowing from a trend of 5% a year over a decade to 3% in 2017 – equivalent to the sector adding 170,000 households in a year.

The private rental sector now comprises 5.7 million households with 1.9 million mortgaged properties.

“This has naturally hit confidence in the sector, with the number of house purchases falling as a result. However, landlord sentiment has stabilised in the last quarter; 41% of landlords hold a positive outlook for their portfolio over the next 12 months,” says the report Buy to Let Britain from lender the Kent Reliance.

“Confidence has climbed from the record low of 36% in the second quarter of 2017, but remains well below the level seen three years ago. Larger-scale investors are the most confident; 44% of landlords with 20 or more properties are optimistic, compared to just 38% of single-property landlords.

“Sustained profitability in the face of taxation changes has underpinned landlords’ confidence: 85% of landlords turn a profit, while just 3% state they make a loss.”

How landlord confidence has dipped