Buy to let lenders have kicked off a campaign with new statistics that reveal the private rental sector may not be enjoying a boom time but may face an uncertain future due to new borrowing restrictions and taxes.

Trade body The Council of Mortgage Lenders (CML) speaks for more than 90% of buy to let lenders and has released a study that shows the lettings market is not as buoyant as many believe.

The true picture, says the CML, is lenders and landlord fear that new measures to curb borrowing and increase their taxes may shrink the market in the short term.

“We are publishing some new statistics on the geographical spread of buy to let and the types of properties favoured by investors,” said a CML spokesman. “This data is not necessarily indicative of the way in which we would like to expand our market coverage, but it does present some new insights into the sector.”

The statistics are the first publication ever of data from all lenders about buy to let.

Some key facts are:

- Since 1999, buy to let landlords have taken on 1.7 million mortgages worth more than £200 billion

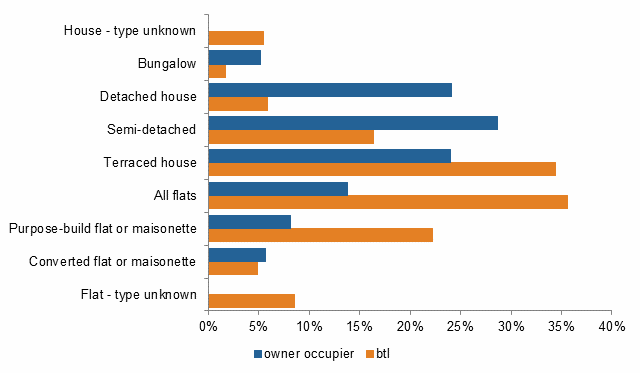

- Flats and terraced houses comprise almost 70% of all mortgaged buy to let homes

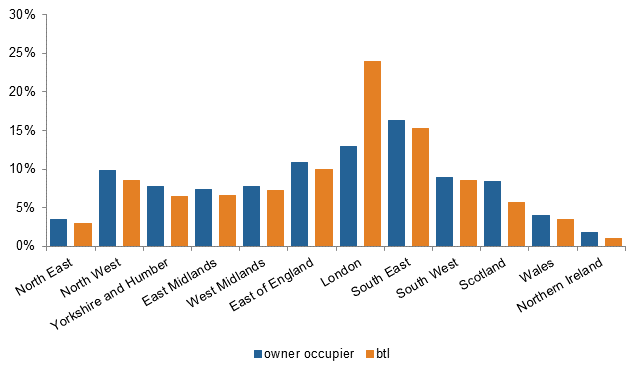

- London is the only region where buy to let properties outnumber owner-occupier homes

Buy to let v owner occupation

Source: CML regulated mortgage survey and buy-to-let mortgage survey

Target homes for buy to let landlords

Source: CML regulated mortgage survey and buy-to-let mortgage survey

More about the CML study and buy to let borrowing.

Read the full CML report ‘Buy-to-let: the past is no guide to the future’