Private rents seem reinvigorated after spending months stuck in the doldrums, according to the latest data.

The Office of National Statistics (ONS) reports rents up 1.5 per cent in the year to October – a modest 0.2 per cent increase over the month before and a return to monthly rent rises seen in January 2020.

Since then, a downturn in the cost of London rents has dragged the market with growth of just 0.1 per cent, ranking the lowest in the country.

“This reflects a decrease in demand, such as remote working shifting housing preferences, meaning workers no longer need to be close to their offices. It also reflects an increase in supply, such as an excess supply of rental properties as short-term lets change to long-term lets,” says the ONS report.

Trade body the Association of Residential Letting Agents (ARLA) added in their Private Rented Sector Report, September 2021 members reported a record high in the number of prospective tenants, breaking the September 2020 record.

The number of tenants experiencing rent increases fell slightly from 79% in August to 75% in September.

Contents

Tenant demand increasing

The Royal Institution of Chartered Surveyors’ (RICS’) August 2021 Residential Market Survey confirmed tenant demand accelerated in August.

Separate data from tenant referencing firm Homelet shows the average UK rent is now £1,058 a month – 8.5 per cent up in a year but down 0.1 per cent from last month.

HomeLet CEO Andy Halstead said: “This year has been strange, with the effects of the pandemic still being seen across the housing market. Despite the disruption and uncertainty we’ve all seen, we have referenced almost a million tenants, which highlights the considerable level of demand that exists. People still need and want to move home.

“The private rented sector has remained exceptionally resilient, and demand for property has remained high, something we expect to continue seeing as we shortly say goodbye to 2021 and look forwards to the opportunities 2022 will bring.

“The UK needs landlords; if demand continues to outstrip supply, then prices can only go up. Typically, we might see a rise in rental prices for desirable or emerging areas, but high demand has been seen for some time now, and that applies to practically every area of the UK. With fewer new properties coming up to rent when compared to pre-pandemic levels, we can expect the trends we see continuing throughout 2022.”

City rents bouncing back

Property portal Rightmove reports rents in Bristol, Nottingham, and Glasgow are 10 per cent higher than pre-pandemic levels.

Data shows high demand and quick turnarounds are seeing London rents start to rise at their fastest ever rate.

Rightmove’s Director of Property Data Tim Bannister said: “A year of various lockdowns saw many city centres hit with either a complete standstill in rental growth, or falls of over ten per cent in some cases, as tenants moved further out or back in with family temporarily.

“But as society opened up again, cities have not only bounced back but are now seeing strong rental growth, fuelled by increased tenant demand and limited available stock. It’s still easier to secure a place in a city centre than in some of the hottest suburban and rural rental markets right now, but as more tenants boomerang back to busier locations, this is likely to change.

“The shortage of rental properties in the market has led to Rightmove recording the fastest ever pace of rent rises in a year than ever before, and there are finally green shoots of growth in London’s rental market, with the first annual rise since before the pandemic started. Demand is notably up in London compared with this time last year, another sign that people are reconsidering where they want to live.”

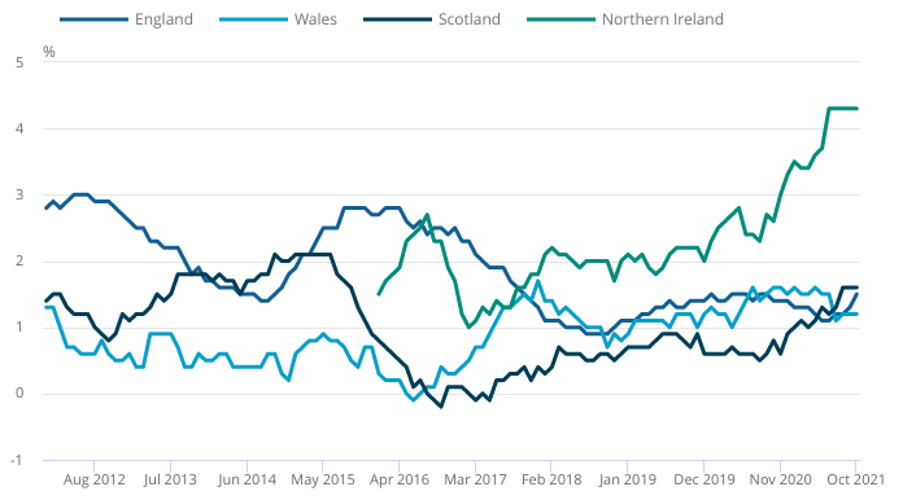

Rent changes by country

The latest data shows rents in Scotland and Northern Ireland continue to outperform those in England and Wales, although the gap is closing.

Source: ONS

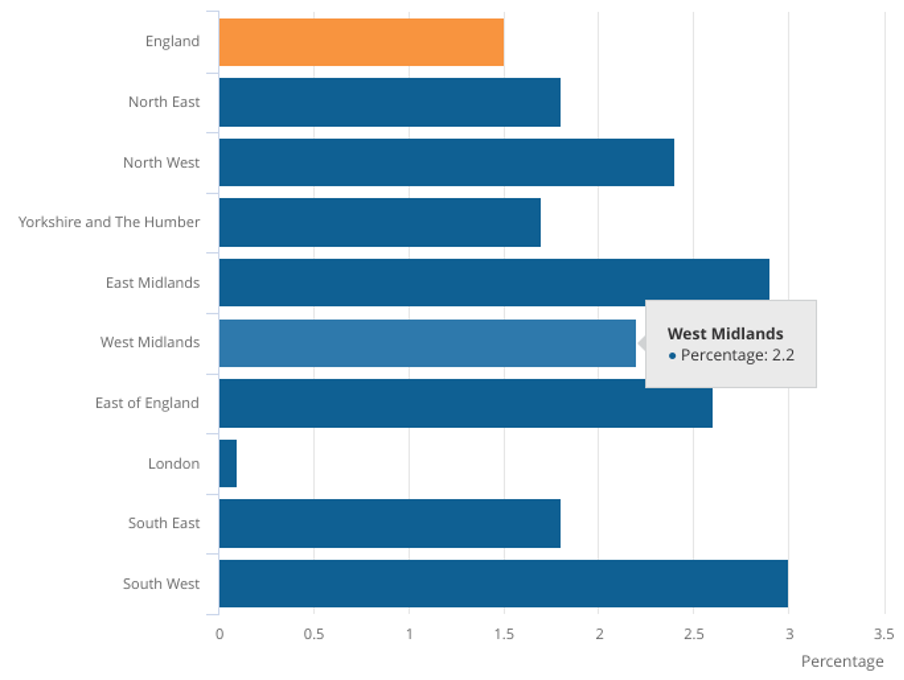

Rent changes by region

The South West is the best performing region for landlords, returning a three per cent annual increase, says the ONS. London had the weakest return, with a growth of 0.1 per cent.

Source: ONS

The table shows the average rents throughout the UK for November 2021:

| Region | Rent Nov 2021 | Rent Oct 2021 | Rent Nov 2020 | Monthly change | Yearly change |

| East Midlands | £729 | £728 | £689 | 0.1% | 5.8% |

| East of England | £1,030 | £1,027 | £968 | 0.3% | 6.4% |

| London | £1,757 | £1,759 | £1,576 | -0.1% | 11.5% |

| North East | £575 | £588 | £536 | -2.2% | 7.3% |

| North West | £835 | £832 | £766 | 0.4% | 9.0% |

| Northern Ireland | £737 | £729 | £646 | 1.1% | 14.1% |

| Scotland | £740 | £738 | £687 | 0.3% | 7.7% |

| South East | £1,129 | £1,132 | £1,065 | -0.3% | 6.0% |

| South West | £964 | £960 | £910 | 0.4% | 5.9% |

| Wales | £742 | £742 | £673 | 0.0% | 10.3% |

| West Midlands | £785 | £792 | £753 | -0.9% | 7.1% |

| Yorkshire & Humberside | £736 | £727 | £677 | 1.2% | 8.7% |

| UK | £1,058 | £1,059 | £974 | -0.1% | 8.6% |

| UK excluding London | £889 | £888 | £828 | 0.1% | 7.4% |

Source: Homelet

Rent changes Q3 2021

National average asking rents for all property excluding Greater London:

| Quarter | Monthly asking rent | Quarterly change | Yearly change |

| Q3 2021 | £1,047 | 3.9% | 8.6% |

| Q2 2021 | £1,007 | 2.6% | 6.2% |

Source: Rightmove

Greater London average asking rents for all property types:

| Quarter | Monthly asking rent | Quarterly change | Yearly change |

| Q3 2021 | £2,019 | 3.6% | 2.7% |

| Q2 2021 | £1,949 | 1.5% | 3.1% |

Source: Rightmove

More information

We have more investing in property information for England and Wales.

See more articles from the statistics category here.