House prices have dropped by a moderate 0.2% month-on-month, according to the latest data.

Despite the fall, homes across the country are still worth a little more now than a year ago, says the Office for National Statistics.

The latest monthly house price report – for September – calculates an average home costs £234,370 after a 1.3% year-on-year increase in UK residential property prices.

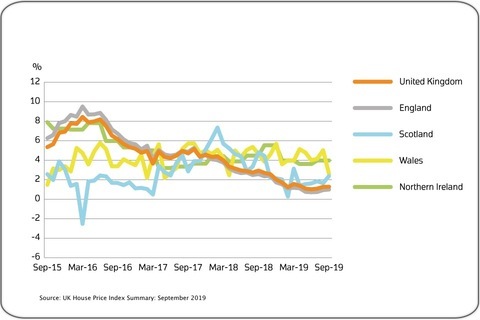

However, prices do vary between regions.

Homes in England decreased 0.1% between the end of August to the end of September, with an annual rise of 1%, with an average property worth £250,677.

In London, process dropped 0.4% over the year. An average home in the capital is now £474,601.

Values dropped the most in the East Midlands, where they were down 1.2%, but rose the most in North West, where they surged by 2.8%.

House prices in Wales have dropped 2.8% since August 2019, leaving an annual rise of 2.6% taking the average property value to £164,433.

Meanwhile, separate ONS research posted buy to let rent data for the year to October.

Although rents rose 1.3% over the 12 months, in cash terms this reflects a £6.50 a month increase in a monthly rent of £500 in October 2018.

Over the year, rents increased were up 1.4% across England and 1.2% in Wales.

The largest annual rental increase was in the South West (2.2%), up from 2.1% in September 2019, followed by the East Midlands (1.9%), Yorkshire and the Humber (1.8%) and the South East (1.7%).

Lowest growth was in the North East, where rents increased 0.4%, followed by London, where tenants paid 0.9% more than in October 2018.

Since January 2015, when the ONS started analysing rent data, prices paid by tenants rose across the UK by 8.1%.