More people inherit residential property than any other asset, according to new research.

But only the wealthiest families with estates of £2 million or more pass on residential property, which comprises an average fortune of £1.6 million.

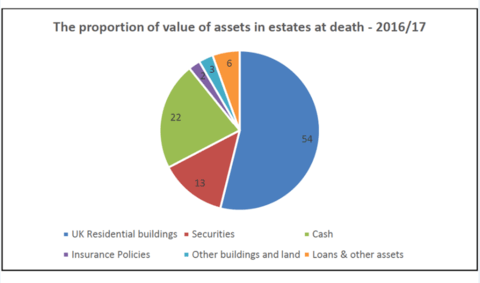

Every year, wealth of £80 billion passes between generations, with homes worth £43 billion inherited – which accounts for 54% of all wealth passed down, the data shows.

Cash is the second most popular way of passing on wealth with £17 billion averaging £69,000 an estate left each year, even though this is poor financial planning as inflation quickly erodes the spending power of money.

Stocks and shares adding up to £10 billion account for 13% of inherited wealth, while the rest is held in insurance, loans and other assets worth around £8.5 billion.

The research by wealth manager Equiniti Benefactor pinpoints the importance of later life financial planning for landlords.

From April 2020, an estate of more than £650,000 attracts inheritance tax on the surplus at a rate of 40% for couples, although additional relief of up to £350,000 is available for passing on a family home to close relatives. The limits are halved for single people.

“For estates to be holding nearly £70,000 in cash at the point of death raises questions about how people are handling their finances in later life. Even through the process of probate, this wealth will be eroded through inflation, while a pot of money held in cash throughout retirement will suffer more serious problems,” said spokesman Stuart Simpson.

“HMRC’s figures show that around a third of estates that include a property now break the inheritance tax (IHT) threshold, demonstrating that estate planning should be a key part of our financial lives. IHT can be a nasty shock for those who are not aware of their limits and the fees their loves ones may incur on wealth that is being passed back down to family and friends.”