With almost endless choices, where to invest is often the toughest decision a buy to let landlord must make.

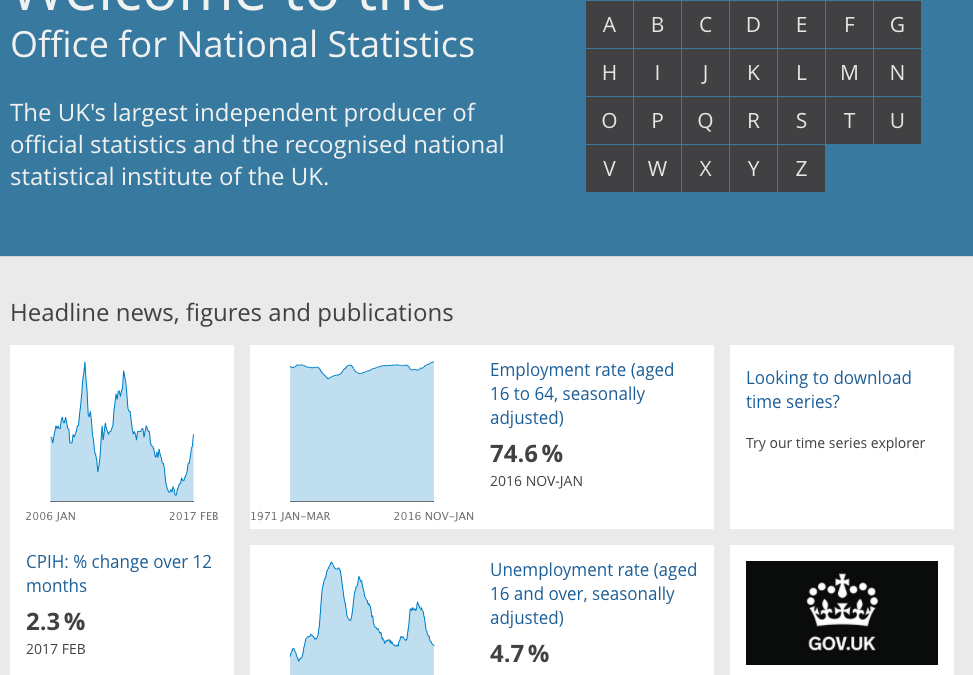

The latest property insight from the Office of National Statistics (ONS) reveals some interesting facts and figures that might help landlords decide where to spend their money.

A report looks at house prices by neighbourhood between December 1995 and September 2016 and draws some conclusions.

The essential take-away is the price gap between the cheapest and most expensive neighbours is widening.

On average, the gap has increased by £60,000 over the period of the analysis.

The former mining village of Horden, County Durham, is pinpointed as the place with the cheapest homes in England and Wales.

A two-bed cottage sells for around £24,500 and, according to Zoopla, returns an average rent of around £390 a month, giving a yield of 19%.

On face value, that return is fantastic, but delving into the data shows that Horden has been a depressed area since the pit closed in 1987, with homes changing hands at low prices.

Zoopla and other web sites have around 57 Horden homes available to rent.

The likelihood is low prices and high yields have attracted landlords who have not realised that there is a reason for the cheap prices – no one seems to want to live in Horden.

House prices in Horden will stay cheap, while those in more desirable nearby neighbourhoods will rise, with the margin between the two widening.

In 2012, some streets in Burnley offered the cheapest homes to buy in the country. The average home price was £42,000. In the intervening period, prices have stayed low – falling by 16% to an average £35,000.

Meanwhile, in the most expensive neighbourhood, property prices have soared by 77%.

Average home prices in Westminster, Central London, were £1.65 million in September 2011. Five years later, the figure was £2.92 million.

The price gap with Burnley was £1.878 million in 2011, growing to £2.885 million by September 2016.