House prices are still rising as buyers race to beat the stamp duty holiday deadline, but many may face disappointment as properties for sale dry up.

Estate agents say owners don’t want to sell during the COVID-19 lockdown because they fear contracting the deadly virus.

But the lack of supply is pushing up values with the price of homes in Liverpool hitting a 15 year high.

This rent digest looks at the data from several sources for a snapshot of the current market.

Contents

House prices still rising

Pent up demand from the first lockdown absorbed much of the supply of homes for sale last year, leaving the market with 7% fewer homes than a year ago.

Lack of supply and continuing demand during the stamp duty holiday has pushed prices up 4.3% year-on-year, says property portal Zoopla’s latest UK House Price Index.

The report puts the average UK house price as £223,700 for December 2020.

Zoopla also reports property prices in Yorkshire and the Humber, the North East and North West have all reached the highest since before the 2009 global financial crisis.

“Despite the new lockdown, demand for homes has posted the usual seasonal rebound which has been stronger than last year. Demand for homes is up 13% on this time last year, with new sales agreed also up 8%. This rebound is broadly uniform across all regions and countries,” says the report.

“It is a continuation of above average demand and market activity from the first half of last year. The ongoing impact of the pandemic continues to drive moving intent amongst home-owners. Some new buyers will be looking to beat the stamp duty deadline.

“In a normal year over 50% would make it, but far fewer are likely to complete a sale in time this year given the volume of business in the pipeline and longer completion times, unless they look to buy a new home.”

Property deals set new records

House prices soared by 7.6% in the year to the end of November 2020, according to the latest data from the Office for National Statistics.

The ONS says the price of an average UK home is £250,000 – a new record.

Regionally, the average home in England costs £270,000 and £180,000 in Wales.

Meanwhile, the average home price in London has passed £500,000.

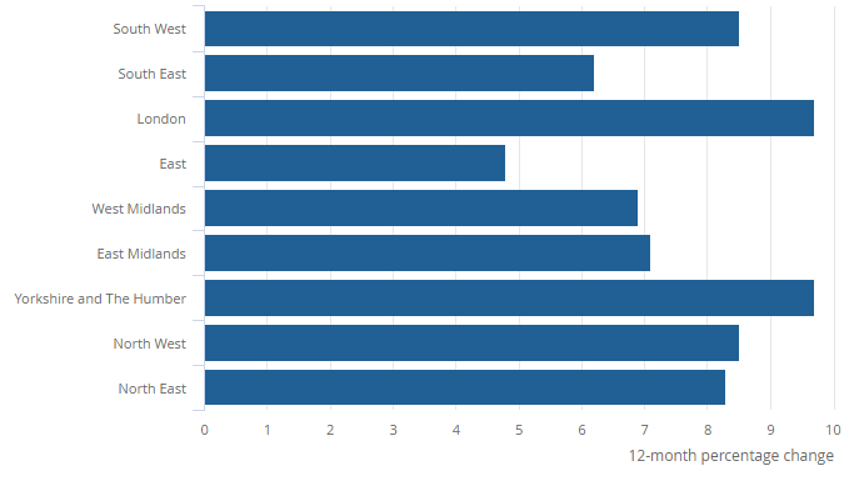

The ONS figures vary slightly with Zoopla, with Yorkshire and Humber posting a 9.7% year-on-year increase, followed by the North West and South West with 9.3%, while the North East saw an 8.5% rise.

“London’s average house prices remain the most expensive of any region in the UK at an average of £514,000 in November 2020. This is a record high and the first time London’s average house prices have surpassed £500,000,” says the ONS report.

House price changes – November 2019 until November 2020

Source: ONS

Buyers look for larger homes

Britain’s biggest chain of estate agents and surveyors agrees annual house prices have increased by 7.8% – but puts the price of an average home at £326,762.

The house price data from Acadata reflects data supplied by estate agents Your Move and Reeds Rain.

“December has clearly ended on a high. House prices in the month have continued to climb, with the monthly % rate of house price growth now standing at 1.4% and the annual rate reaching 7.8%. The rapid increase in the average price that has taken place since the end of the first lockdown, up by some £27,500 from June. The average house price in England and Wales now stands at £326,762 which establishes a new record level for the fifth month in succession,” says the Acadata report.

The data also shows that more buyers are looking at larger, more expensive homes outside cities because they have more space.

Still no clue over stamp duty holiday extension

Chancellor Rishi Sunak is playing his cards close to his chest over if the stamp duty holiday will be extended.

Currently, homes purchased for up to £500,000 in England are free of stamp duty. The holiday ends on March 31.

An online petition calling for a six-month extension to the holiday signed by more than 140,000 people has forced a debate on the topic in the Commons.

The government responded: “The stamp duty holiday was designed to be a temporary relief to stimulate market activity and support jobs that rely on the property market. The government does not plan to extend this temporary relief.”

However, since the debate, Financial Secretary to the Treasury Jesse Norman has declined to comment on calls for the extension, hinting that sales in the pipeline before March 31 may qualify for the stamp duty discount.

The Welsh Assembly has a separate stamp duty policy.

House Prices Digest FAQ

The figures for average house prices and movements in property values can be confusing if you don’t know how to read the data.

Here are some of the most asked questions about house price indices.

Why are the average property prices different in each report?

The reports use different data to draw their conclusions and take the data from different periods.

The Nationwide and Halifax indices are based on their customer data, which are much smaller samples than the national data analysed by the ONS.

Acadata’s methodology includes analysis that no other index uses.

Each organisation collects data over different time periods – the Nationwide and Halifax are for the year to September, while the ONS is to the end of July.

What is the average house price?

There’s no such thing as an average home. The figure is simply math calculated from the total value of all transactions in the sample divided by the number of homes changing hands.

Which house price index is the best?

They are all flawed because of the nature of the restricted data they are based on, but the one with the broadest sample comes from the ONS. However, the ONS data is usually the last to market and out of date by three months on publication.

More information

We have more investing in property information for England and Wales.