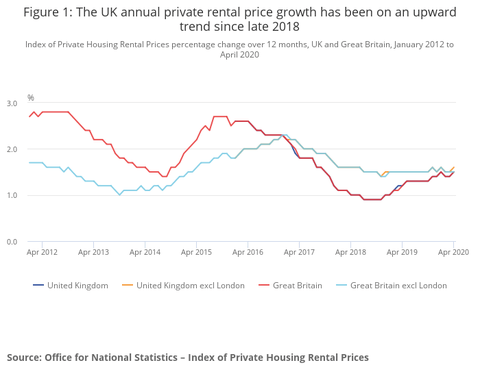

Lockdown buy to let rents have continued to grow on trend, according to the latest official figures.

Private renters saw the cost of a new home rise by 1.5% in the year to the end of April and 1.4% between March and April, says the Office of National Statistics.

In the monthly rent index report, the ONS notes rents increased 1.5% nationally year-on-year.

With London figures excluded, the annual rise was 1.6%.

By country, the rise was 1.5% in England, 1% in Wales and 0.7% in Scotland.

London lagged the rest of England with a 1.3% increase.

Between January 2015, when the index started, and April 2020, average UK rents have grown by 9%.

Regionally, the largest annual increase in rents was in the South West, where tenants paid 2.6% more in April than they did a year earlier.

Not far behind were the East Midlands, where rents were up 2.4% year-on-year.

Other regions beating the UK average rent rise were Yorkshire & Humberside, where they rose 2%, the East of England with a 1.8% increase and the West Midlands with a 1.7% improvement.

The lowest increase was in the North East, where landlords saw rents rise 0.7%, followed by the North West, where they were up 0.9%.

The ONS notes a survey by the Royal Institution of Chartered Surveyors that predicts a sharp fall in house prices, rents, and house sales over the summer.

The research shows declining tenant demand matched by a fall in the number of new rental homes coming to the market.

Letting agents did say they expected the buy to let market to level within 12 months with rental growth expected at around 2.5% a month.

Both reports are based on data collected before the reopening of the housing market.