Landlords Make Four Complaints a Day About Letting Agents

Buy to let landlords made nearly 1,500 complaints to the Property Ombudsman about poor service from letting agents last year. The latest data from the ombudsman reveals 2,757 complaints were made about letting agents in total - with an average of two out of three...

Section 21 Notice Proposed Ban Discussion

We’re just over three weeks after the proposals were announced to ban section 21 notices at some time in the future and it’s time for reflection. This discussion applies to both England and Wales bu some legislation referenced only applies to England at this time....

Buy to Let Lenders Worry About Landlord Tax Planning

Landlords avoiding income tax by taking specialist advice could limit their buy to let mortgage options, one of the UK’s leading lenders has warned. Paragon regional sales manager Tim Sweetman revealed lenders are reluctant to agree loans for landlords implementing...

Cost of Living Is Highest for Private Renters

Renters have a higher cost of living than homeowners, according to the latest official data. Homeowners have seen their cost of living rise by 2.3% a year on average between 2005 and 2018. In the same period, private renters have had a 2.5% annual inflation rate,...

Letting Agents Quit as Legal Squeeze Grips Buy to Let

Letting agents have a record roster of homes to rent on their books but the figures don’t mean landlords are making more properties available. The Association Of Residential Letting Agents (ARLA), the letting agent trade body, claims the increase probably means the...

New Team Ready to Police Letting Agent Fee Ban

A new property agent task force will crack down on letting agents flouting the upcoming ban on charging tenants fees to rent their homes. The new National Trading Standards scheme will monitor letting and estate agents to make sure they comply with new landlord and...

Buy to Let Lending Drops as Tax Changes Bite

Buy to let borrowing from landlords looking to add homes to their rental portfolios is dropping away, according to the latest figures. UK Finance, the trade body for buy to let banks, building societies and other lenders, has revealed borrowing to buy homes to rent...

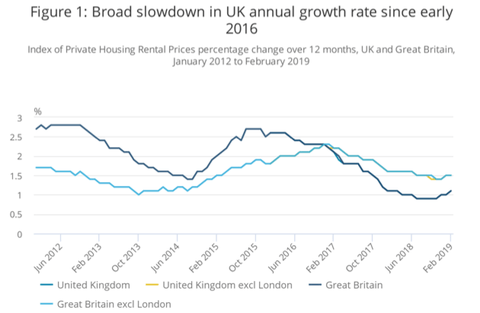

Landlords See Another Disappointing Rise in Rents

Private tenants have seen their rents go up by just 1.2% in the past year, according to the latest official data. That equates to landlords taking an extra £6 on rent of £500 a month, says the Office for National Statistics. The increase is just 0.1% more than the...

What Happened to Naming and Shaming Rogue Landlords?

A year after name and shame powers were given to councils to out bad landlords, no one has been given a banning order. The law came to the statute book in April 2018 and allowed courts to issue orders stopping landlords convicted of criminal housing offences from...

CGT Discount Offered by Hopeful in Tory Leader Race

Former Cabinet minister Dominic Raab has thrown his hat into the ring to become the new Tory leader with a mini-housing manifesto. He is courting favour from millions of landlord and tenant voters by promising to give renters a share of any capital gains tax paid by...

Government Announces Removal of Section 21 Notices

Today, the Government announced its intention to abolish section 21 notices which many would argue is the primary reason for the private rented sector to be the popular industry that it has become since being introduced on 15 January 1989. The Welsh Assembly also...

Lords Call for Landlord Tax Breaks to Improve Housing

Giving landlords extra tax breaks to improve the homes they rent out would boost the plight of any declining seaside towns that are struggling to upgrade, say peers. The House of Lords select committee on regenerating seaside towns has included the recommendation in a...

Check Out a New Inventory Guide for Landlords

An up-to-the-minute guide on how to complete inventories when tenants move in and out of private rented homes is available on line. Designed to help landlords and letting agents avoid disputes with tenants over deposit deductions, the guide lays out how to carry out a...

Letting Agent Repays £1 After Stealing £360,000

Money collected from tenants for landlords is finally safeguarded against theft and misuse as new laws for estate agents have kicked in. From April 1, 2019, all letting agents in England must belong to a client money protection scheme. Agents flouting the rules face...

Landlord Income Tax Grab Enters New Phase

HMRC is set to take another bite out of landlord income tax relief on finance costs with the start of the new financial year. The 2019-20 tax year, which starts from April 6, marks the third stage of phasing income tax relief restrictions down to the basic rate of tax...

CGT Tax Hike Aims to Raise £100m a Year From Investors

Details of the latest tax hike to hit landlords and other property investors have been revealed by the Treasury. This time, capital gains tax is undergoing a major revamp aimed at raising almost an extra £100 million a year over the next five years. The two CGT tax...

Letting Fee Ban Set for Wales From Autumn

Landlords and letting agents in Wales face a ban on charging tenants upfront fees as a new law passes the final hurdle. Members of the Welsh Assembly voted in favour of the ban, which is awaiting Royal Assent and is expected to come in to force in the autumn. The ban...

Updates to Website, Security, 2FA and Articles

We’ve been busy making a number of changes to the website which are mostly in the background. We’ve also updated a few articles. We don’t propose to go into all changes but here are some key changes made: added two-factor authentication for login introduced an awesome...

Buy to Let Rents Still Slowly Rising for Landlords

The cost of renting a buy to let home rose by 1.1% in the 12 months to the end of February. In financial terms, rents across the country were up £5 in a year in England and Wales, but only £3.20 in Scotland (+0.7%). Rents for the UK excluding London increased by 1.5%...

Judge Kicks Out HMRC Stamp Duty Claim

A couple has won a row with HMRC over if they should have paid more stamp duty when they bought a derelict bungalow that was not suitable for them to live in. HM Revenue & Customs challenged the claim by Paul and Nikki Bewley that the bungalow in the West Country...