Landlord property profits when they sell a rented home are dropping, according to the latest data.

Property investors are thought to have sold around 150,000 homes in England and Wales during the past year making an average £78,100 gain.

The analysis by property consultants Hamptons International reveals landlords made a 42% profit on their investment – with 84% recording a capital gain.

The biggest profits were in London, where landlords made average gains of £253,580, compared to those in the region with the lowest gain – £11,170 in the North East. The 15 council districts posting the largest gains were all within the M25 motorway around the capital.

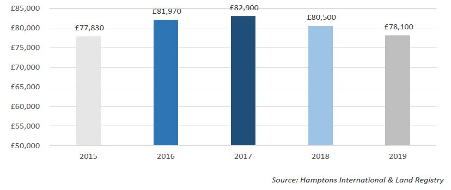

Although property gains have dropped below the average of £81,790 recorded over the past three years, they are still above the £77,830 profit of 2015.

The report also shows rents in May were down 1.6% year-on-year across the country, mainly due to a 4.7% drop in London and a 1.2% fall in the South East. Every other region returned increases, ranging from a 0.8% nudge up in the Midlands to bumper 3.4% boost in Wales.

Aneisha Beveridge, head of research at Hamptons International, said: “The profitability of the buy-to-let market has been questioned in recent years and is one of the main reasons why some landlords have chosen to sell up.

“But one of the biggest bonuses from cashing in comes from the capital gain on a property. Over a third of landlords’ total return comes from capital growth rather than rental income in Great Britain.

“Landlords in the South, where house prices are higher and historic price growth has been stronger, saw the greatest capital gains last year. In fact, the average London landlord gain was over 20 times that of a seller in the North East where landlords are more reliant on rental income.

“But with house price growth expected to stay lower than in the past, more landlords are having to switch their focus to maximise rental income, rather than rely on capital growth.”

Average gross capital gain for landlords since 2015