Buy to let rents are still rising – but worries the tenant fee ban would send them sky-rocketing seems unwarranted.

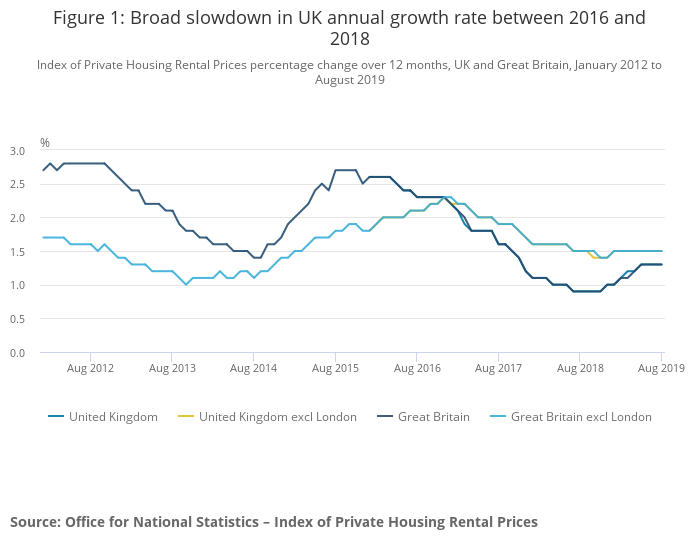

The latest official data from the Office for National Statistics reveals rents increased an average 1.3% for the 12 months to the end of August – a figure that has remained unchanged since May.

The tenant fee ban in England started on June 1 amid fears landlords would switch the costs of setting up a tenancy to tenants rather than swallow the bill.

But around the UK, rents increased much lower than expected – 1.3% in England, 1.2% in Wales and 0.9% in Scotland.

Rents in England were up an average 1.5% when figures for London were excluded.

The rate of increase for the capital was 0.8%.

In England, the highest annual rent increase was 2.0% in the South West, unchanged since May, followed by the East Midlands (1.9%), Yorkshire and The Humber (1.6%) and the South East (1.6%).

The lowest rent growth was in the North East, where tenants pay 0.6% more, down from 0.7% in July, followed by London, which increased by 0.8%, down from 0.9% since July 2019.

Since the ONS started keeping rent data in January 2015, average UK rents have risen by 7.9%.

The ONS Index of Private Housing Rental Prices is published monthly and measures year-on-year rent changes for tenants. Data is compiled from around 500,000 private rented homes each year.

Meanwhile, ONS house price data for July – the latest available figures – shows property values rose an average 0.5% during the month.

Year-on-year, home prices saw little movement, recording a rise of just 0.7%.

In England, the average home is valued at £248,837, compared to £247,981 a year ago.