Well-off renters are running the buy to let market with an increasing supply of homes on the market and few competing tenants, according to new research.

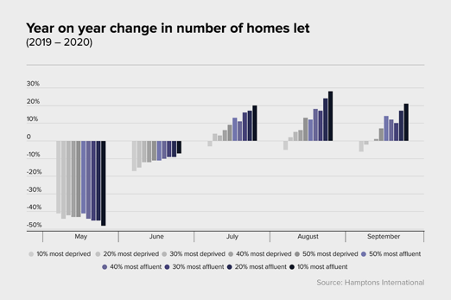

The private rental sector is struggling to revive following the Covid-19 lockdown that saw the number of homes let drop by nearly 50% at the lockdown’s worst in May.

Data from property consultancy Hamptons International year-on-year rentals dropped by 5.3% between May and September.

But the analysis with the same period a year earlier reveals the UK’s least affluent neighbourhoods have suffered worse. In the poorest 10% of neighbourhoods, rentals collapsed by 14.8%, while in the best off, rentals were 1.3% down.

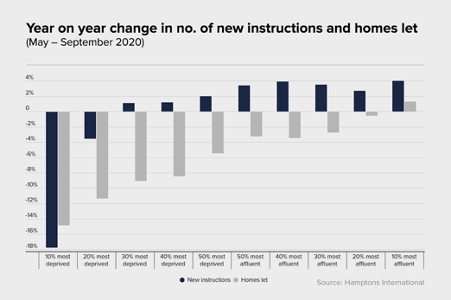

From May to September, only new instructions in the least affluent areas were still in the red – down 17.7% compared to a year earlier.

Meanwhile, the better off areas saw a year on year increase of 20% of new rental homes for letting.

“To some surprise, the lettings market has recovered more slowly from lockdown than the sales market. Although activity appears to be returning, the recovery in this market has been more U-shaped than V-shaped,” says the report.

“Demand from tenants is down, partly as result of a leap in the number of first-time buyers – another thing that has surprised this year. Job insecurity means that other younger people are delaying a move out of the family home and into rental accommodation.

“At the same time, the number of homes to let has fallen. The reluctance of landlords to invest is lowering the supply of rental homes which may put a floor under rents at some point in the future.”

Contents

Rents set to fall

Rental growth depends on how the Covid-19 pandemic affects the job market, explains the analysis.

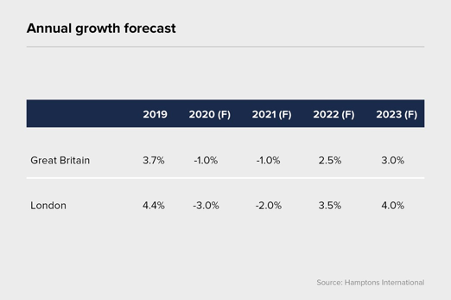

The forecast is for rents in London to plunge by 3% in the coming months with a recovery towards the end of next year.

“Until the direction of the economy becomes clearer, we expect rental growth to lag house price growth at least until 2022, with falls in rents this year and next. However, the market should stabilise towards the end of 2021,” says the report.

“The decline in rents seems set to be deepest in London, where Airbnb and other short-term let properties have been switched to the long-term market. This has been prompted by a drop in the number of international students and tourists.

“There are also fewer well-paid overseas executives seeking temporary homes in London. As a result, we forecast a 3% fall in rents in the capital this year and a 1% fall in 2021.”

The data shows 44% of landlords gained a higher rent when reletting a home in 2020 compared with 47% a year earlier.

Also affecting London is a shift in the choice of where to live as Londoners desert the capital in favour of country towns and cities.

Tenants spoilt for choice

Working from home has enabled better-off renters to consider relocating to more rural areas even if they must commute to an office a couple of times a week.

Several factors are fuelling the exodus –

- Homes with more bedrooms as older children returning to live with their parents from university because they can’t find jobs

- Larger gardens

- Cheaper properties with more living space outside the capital

Separate data from Fleet Mortgages, a specialist buy to let lender, shows rental yields are increasing across England and Wales.

The research comparing Q3 2020 with the same quarter in 2019 shows yields in the north are the highest.

The North East has seen a surge from 6.8% to 8.8%, while the North West has dropped from 8% to 7.8% and 4.9% in London.

Looking at England and Wales, yields have edged up from an average 6% in Q3 2019 to 6.4% in Q£ 2020.

Generally, yields are higher in areas with lower property prices and lower where homes cost the most.

How property prices have changed in a decade

According to research by property portal Rightmove, the UK’s Top 10 property hot spots over the past decade are:

| Area | Current average asking price | % increase since 2010 |

| 1. Easton, Bristol | £283,397 | 120% |

| 2. Walthamstow, East London | £503,651 | 117% |

| 3. Peckham, South London | £555,699 | 107% |

| 4. Swanscombe, Kent | £327,106 | 106% |

| 5. Tottenham, North London | £465,902 | 106% |

| 6. Forest Gate, East London | £479,363 | 104% |

| 7. Elephant and Castle, South London | £510,139 | 103% |

| 8. Whitehall, Bristol | £295,574 | 102% |

| 9. Deptford, South London | £483,917 | 101% |

| 10. Hackney, East London | £617,306 | 100% |

Source: Rightmove

House prices increases don’t apply across the board, says the Rightmove research.

Plenty of areas have seen values fall, with Nairn, Scotland, experiencing the largest drop in the decade – 15%.

The Top 10 biggest price drops were recorded in:

| Area | Current average asking price | % decrease since 2010 |

| 1. Nairn, Scotland | £197,981 | -15% |

| 2. Linthorpe, Middlesbrough | £128,352 | -12% |

| 3. Shildon, Durham | £95,602 | -10% |

| 4. Kilwinning, Scotland | £100,225 | -9% |

| 5. Johnstone, Scotland | £110,115 | -9% |

| 6. Felling, Gateshead | £110,293 | -8% |

| 7. Ferryhill, Durham | £93.026 | -8% |

| 8. Galashiels, Scotland | £136,447 | -8% |

| 9. Wigton, Cumbria | £175,773 | -7% |

| 10. Peterlee, Durham | £100,492 | -7% |

Source: Rightmove

On average, UK house prices have increased by 41% over the Rightmove survey period (2010 -2020) from an average of £226,950 to £319,996.

Rightmove’s Director of Property Data Tim Bannister said: “Demand for property in Bristol is exceptionally strong right now. Average asking prices across Bristol are up by 60% over the past decade and it’s one of the UK’s most thriving regional centres.

“Bristol has a highly diverse mix of housing stock and is a city where a number of tech companies have based themselves, making it an attractive place to move to for many buyers. We know that demand leads to rising prices, but even so, it’s quite a feat that some locations in the city have seen asking prices double since September 2010.

“If you’re a seller who’s lived in Bristol for 10 or more years, this could be a real opportunity to have a look and see if you could afford to trade up.”

What can you buy in Bristol?

With the average home costing £283,907 in Easton, Bristol, here’s a look at what you can get for the money from properties listed on Rightmove:

- A ‘compact and bijou’ Victorian two-up/two down end terrace – £285,000

- A two bed maisonette going to auction with scope to convert to a three-bed home – £100,000

- A two-bed second floor flat – £149,950